ny paid family leave tax category

Youll find answers to your top taxation questions below. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

New York paid family leave benefits are taxable contributions must be made on after-tax basis.

. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2. Based upon this review and consultation we offer the following guidance. Over 13M Americans Filed 100 Free With TurboTax Last Year.

Tax treatment of family leave contributions and benefits under the New York program. Ad See If You Qualify To File State And Federal For Free With TurboTax Free Edition. After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program.

Paid Family Leave provides eligible employees job-protected paid time off to. Confirm the clients state is NY. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax.

New York Paid Family Leave premiums will be deducted from each employees after tax wages. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA.

Employees can request voluntary tax withholding. Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA. Your PFL benefits are taxable.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a state disability insurance tax. Fully Funded by Employees.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. What category description should I choose for this box 14 entry. The contribution remains at just over half of one percent of an employees gross wages each pay period.

Employee-paid premiums should be deducted. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

They are however reportable as income for IRS and NYS tax purposes. Fully Funded by Employees. The benefit amount be included in federal gross income.

Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Set the appropriate NY rates for Family. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. Paid Family Leave benefits need to be reported on a 1099-Misc as taxable non-wage income.

The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. The maximum annual contribution is 42371.

Fully Funded by Employees. The maximum annual contribution for. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Benefits paid to employees will be taxable non-wage income that must be included in federal gross income Taxes will not automatically be withheld from benefits.

_800_519.png)

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Your Rights And Protections Paid Family Leave

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

Paid Family Leave For Family Care Paid Family Leave

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

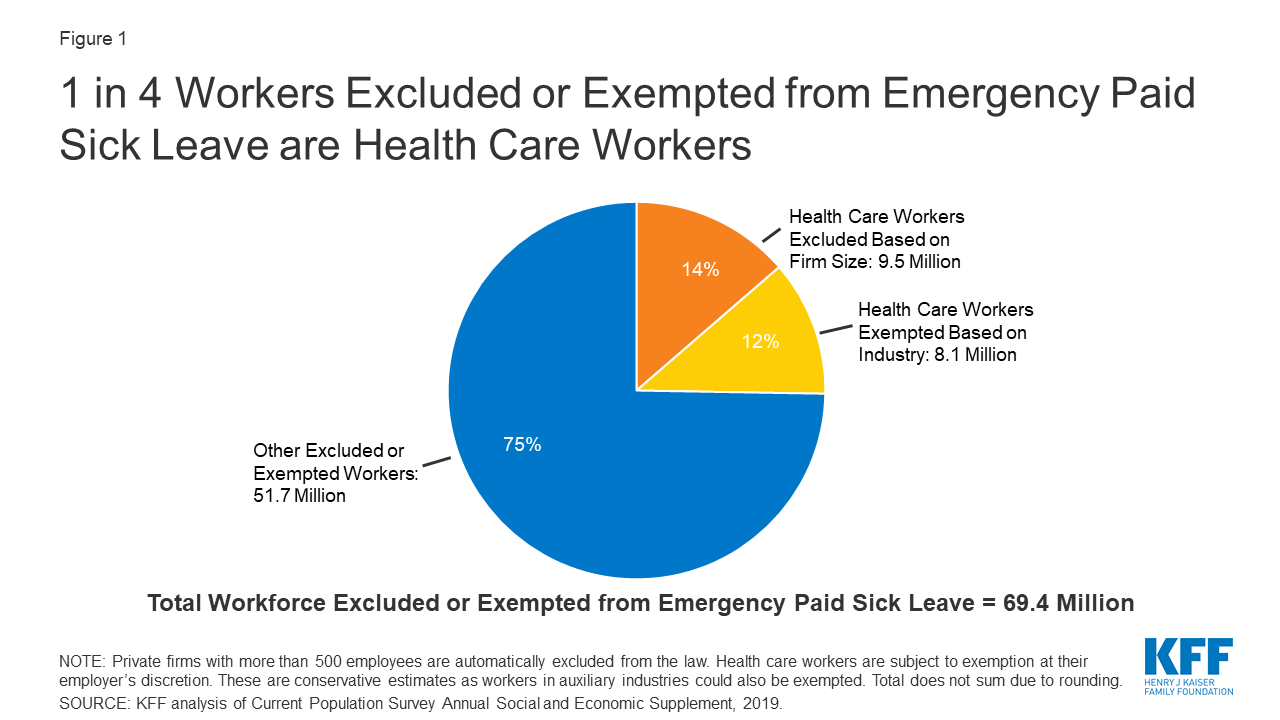

Gaps In The Emergency Paid Sick Leave Law For Health Care Workers Kff

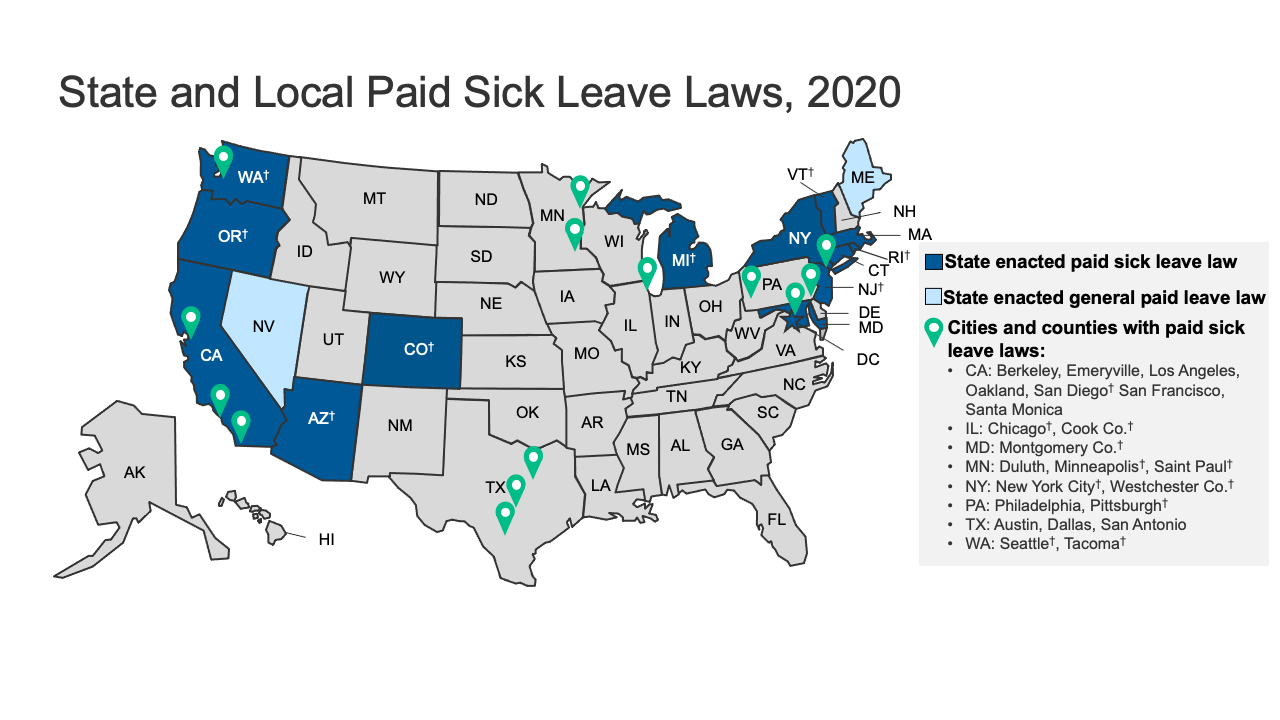

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

New National Paid Leave Proposals Explained

New National Paid Leave Proposals Explained

Cost And Deductions Paid Family Leave

New York Paid Family Leave Updates For 2022 Paid Family Leave

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation